Содержание

This boils down to earning rewards by holding and not trading certain cryptocurrencies for a set time. Then again, staking means your coins are earning you potentially significant returns instead of sitting in your wallet while waiting for a price spike. The Huobi Wallet is available for Android and iOS, and it’s a self-custodial wallet (so you’re in charge of your own keys).

- It’s also restricted to just 13 cryptocurrencies, though that includes all the stable names, such as Bitcoin, Bitcoin Cash, Ethereum, Dogecoin, and Shiba Inu.

- Before choosing a cryptocurrency wallet, it’s crucial to think about how you intend to use it so you can select the most suitable wallet.

- Being paper, these wallets cannot be “hacked,” but they’re very easy to lose or accidentally destroy.

- Select a wallet to store your bitcoin so you can start transacting on the network.

So as the value of your crypto becomes more significant, you could benefit from the added security that comes with your own wallet. Users can also buy or sell crypto through the Buy Crypto interface available to Blockchain Wallet. To make a purchase, a user can either transfer funds from a bank, use a credit or debit card, or use the available cash balance. E-wallets allow individuals to store cryptocurrencies and other digital assets. In the case of Blockchain Wallet, users can manage their balances of various cryptocurrencies such as the well-known Bitcoin and Ether as well as stellar, Tether, and Paxos Standard. Broadly speaking, a blockchain wallet is a digital wallet that allows users to store, manage, and trade their cryptocurrencies.

Best Online Stock Brokers For Beginners

If the organization is hacked then you may lose all your bitcoin’s. It’s important that you keep track of your Bitcoin wallet’s key. If someone else has it, they can hack into your wallet and send it to their own wallet. And, if you lose your key, you could lose access to your cryptocurrency.

Instead, transactions are tied to addresses that take the form of randomly generated alphanumeric strings. Initial growth of the Bitcoin network was driven primarily by its utility as a novel method for transacting value in the digital world. Early proponents were, by and large, ‘cypherpunks’ – individuals who advocated the use of strong cryptography and privacy-enhancing technologies as a route to social and political change.

An ideal crypto wallet would be secure, convenient and easily operated. When dealing in large sums, it can be a good idea to keep some funds on a hardware or offline wallet and some on an online wallet for easy trading. You can add funds to a Bitcoin wallet through any crypto exchange that accepts fiat currency. You can top up using a wire transfer or instantly using a debit card, and from there simply buy Bitcoin in the exchange and it will appear in your wallet.

Creating an e-wallet with Blockchain Wallet is free, and the account setup process is done online. Individuals must provide an email address and password that will be used to manage the account, and the system will send an automated email requesting that the account be verified. Hardware wallets like Ledger and Trezor are the most secure but also the least convenient. As they are offline devices, you’ll need to connect them to an online device to use. They can be tricky to set up which makes them more suitable for intermediate or advanced inventors.

Blockchain Wallet Security

This is possible on Trust Wallet and Coinbase Wallet for example. For the former, you can buy Bitcoin using the browser extension on your PC or directly from within the app on your smartphone. To do so on the Coinbase Wallet, you will need to connect it to your Coinbase account by following the on-screen instructions. Notably, this process may include higher fees than if you were to buy from an exchange or brokerage platform.

Mobile wallets tend to be compatible with iOS or Android devices. Trezor, Electrum, and Mycelium are examples of wallets that you can use. Web wallets are hosted on a server somewhere else, rather than on your own computer. Because Web wallets are remote, you can access them from any computer; however, that makes them more vulnerable to hackers.

His work has appeared in CNBC + Acorns’s Grow, MarketWatch and The Financial Diet. Bitcoin is poised to revolutionize the way individuals and companies do business online. Make sure you don’t get left behind by learning the basics of bitcoin in our bitcoin education center. He has over a decade of experience writing in the personal finance space for outlets such as Creditcards.com, creditcardGenius.ca, Yahoo Finance Canada, Nerd Wallet Canada and Greedyrates.ca. The comparison service on our site is provided by Runpath Regulated Services Limited on a non-advised basis. Forbes Advisor has selected Runpath Regulated Services Limited to compare a wide range of loans in a way designed to be the most helpful to the widest variety of readers.

Some services are insured by underwriters to protect against theft or loss of Bitcoin, but anonymous users will have difficulty finding services that do not require some proof of identity. You should check the location, storage technology, reputation, commission rates, and how funds can be accessed before choosing a cold storage service. Bitcoins from cold wallets can only be stolen by hackers who have access to the wallet and know the passwords or PINs required to access the funds.

Hot Wallets

A cryptocurrency wallet is an application that functions as a wallet for your cryptocurrency. It is called a wallet because it is used similarly to a wallet you put cash and cards in. Instead of holding these physical items, it stores the passkeys you use to sign for your cryptocurrency transactions and provides the interface that lets you access your crypto.

No matter which wallet you choose, be sure to keep security top of mind. You’ll need to safely store your seed phrase, which is a series of words generated by your wallet that allows you to access your crypto. The basic difference between custodial and noncustodial wallets is that a custodial wallet’s private key is held by a custodian, or a third-party. For example, if you get your wallet through a crypto exchange, it’s likely a custodial wallet, and the exchange likely holds the keys. A cryptocurrency wallet is a software program that stores your cryptocurrency keys and lets you access your coins.

Which Cryptocurrency Wallet Is Best?

Private wallets on the other hand require more technical knowledge but come with more features. For example, staking, which is earning interest on your crypto holdings and the ability to send and receive non-fungible tokens . Another critical thing you should know is the difference between cold wallets versus hot wallets.

Desktop wallet software often varies in features, with some focused on security and others focused on anonymity, for example. You should take these varying features into consideration when choosing software you wish to run. A Paper Wallet a bitcoin private key and a corresponding address written or printed on a piece of paper. A Web Wallet is any bitcoin wallet where your private coins are stored entirely online.

How Much Money Do I Need To Invest In A Bitcoin Wallet?

Desktop or Mobile Wallets systems are much cheaper and far more accessible, as they store one’s coins on an app installed onto one’s computer or handheld device. These wallets such as Hive Android or Mycelium have a high degree of accessibility allowing for easy trade through QR codes or Near Field Communication. cryptocurrency paper wallet The drawback to this accessibility is that they are considered ‘hot’ or online, and therefore more vulnerable to malware and phishing attacks. Ledger is bluetooth-enabled and comes with a desktop and a mobile app called Ledger Live. To access or transfer funds, you’ll need to connect it to an online device.

Blockchain Wallet has several levels of security to protect user funds from any possible attacker, including the company itself. However, it’s important to note that the Blockchain Wallet uses a process they call dynamic fees, meaning that the fee charged per transaction can be different based on various factors. Both the transaction size and the conditions of the network at the time of the transaction can greatly impact the size of the fee.

These are typically servers at the wallet manufacturer’s location or the wallet’s back-end exchange. Even though the internet connectivity makes hot wallets notably less secure than cold wallets, they’re still the most popular. That’s because many can make trades without a separate connection to an exchange, and they can store other kinds of digital assets besides cryptocurrency.

When you buy cryptocurrency, you generally aren’t tethered to any one wallet brand or type. Take time to read reviews about user experience, extra features and, of course, security. Pay attention if a wallet has ever been hacked and avoid those that have faced serious breaches in the past.

It can and has integrated changes throughout its lifetime, and it will continue to evolve. The listed author of the paper is Satoshi Nakamoto, a presumed pseudonym for a person or group whose true identity remains a mystery. Nakamoto released the first open-source Bitcoin software client on January 9th, 2009, and anyone who installed the client could begin using Bitcoin. At a deeper level, Bitcoin can be described as a political, philosophical, and economic system.

Types Of Bitcoin Wallets

EToro is a multi-asset trading platform that offers markets for several cryptocurrencies including Bitcoin. The platform provides a secure free crypto wallet for all the cryptos on its platform with security features that include 2-factor authentication, and data encryption. Crypto wallets enable users to send and receive digital assets across the globe without any intermediaries after buying any cryptocurrency. In this case, we are talking about buying bitcoin and storing the assets.

While the recovery phrase is an improvement upon the private key, it still leaves a lot to be desired. Since you shouldn’t store your recovery phrase in plain text on your computer, for most people the best solution is to write it down on paper. This presents problems because safely storing a piece of paper can be hard. Further, if you’re using a multi-coin wallet (like the Bitcoin.com Wallet), you’ll have a separate recovery phrase for every different blockchain your wallet supports.

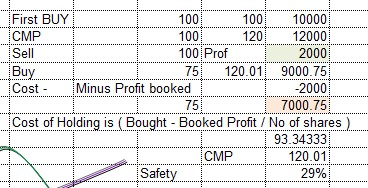

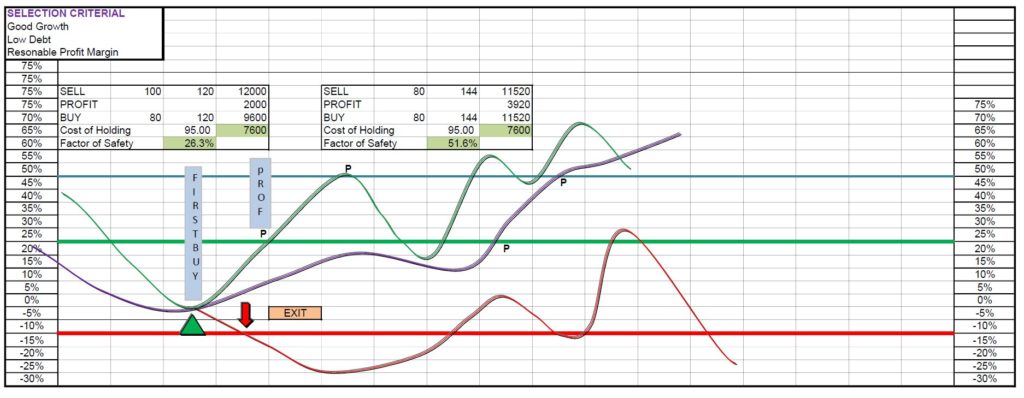

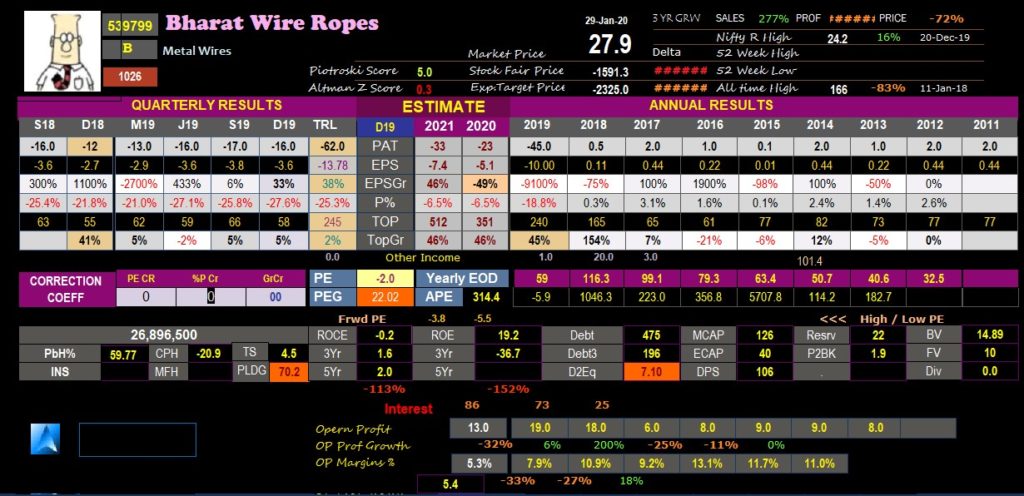

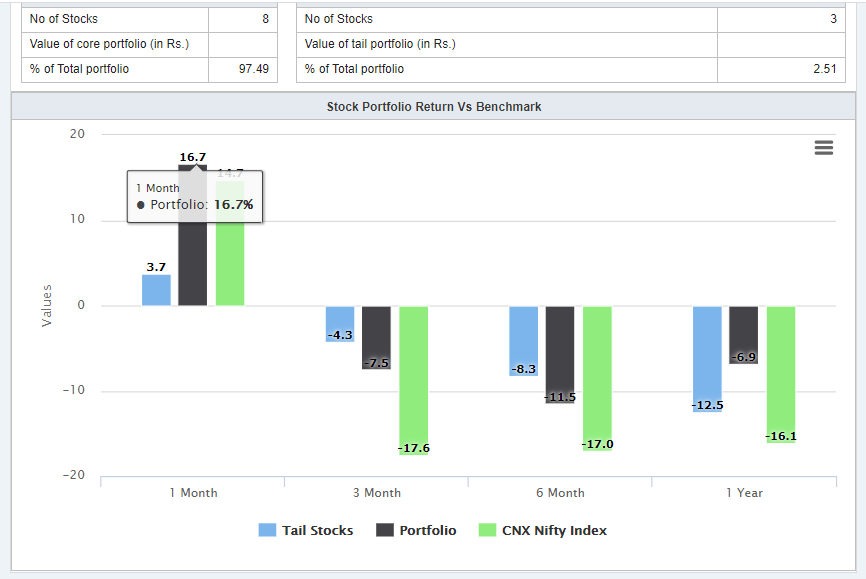

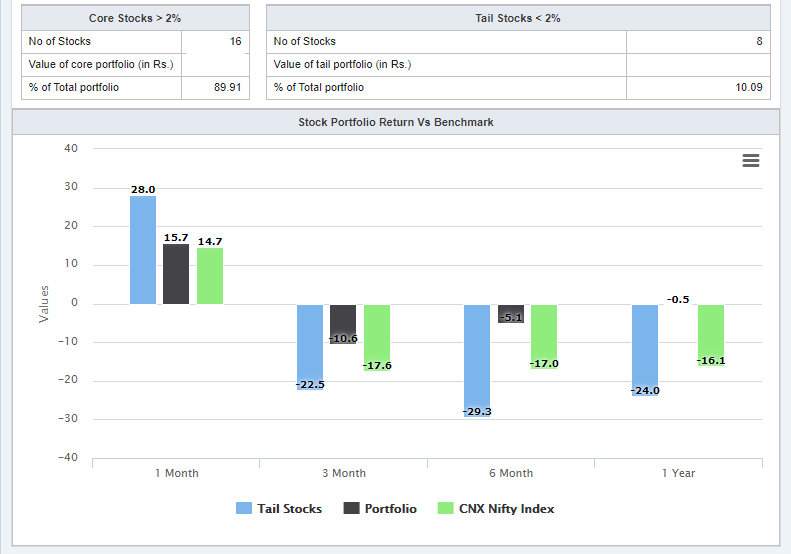

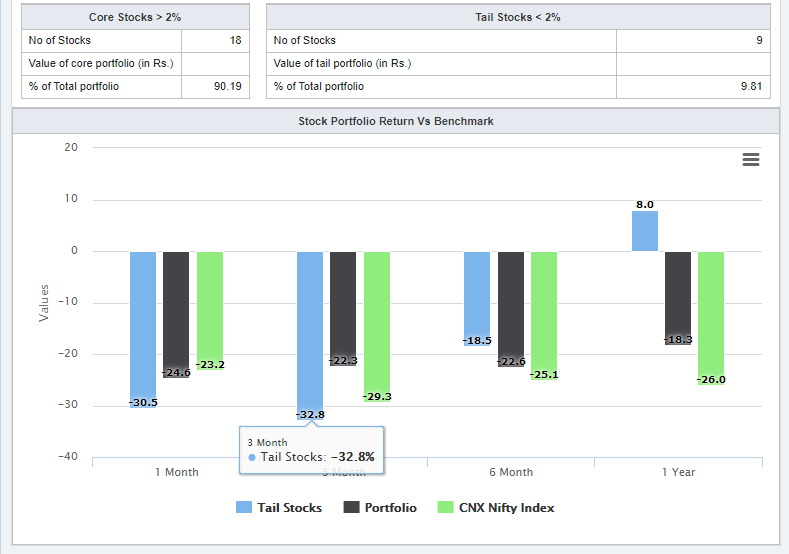

I collect watchlist of stocks from Result performance, Expert Picks, Recommendations from fund houses etc … and buy the first lot at a technically opportune time

I collect watchlist of stocks from Result performance, Expert Picks, Recommendations from fund houses etc … and buy the first lot at a technically opportune time