Dear friends,

I am in a monotonous job routine, a fraction of my capabilities are lauded as that I am doing a great job and I wanted an intellectually challenging alternative intense work to relax.

Like all novices, I was attracted to the market watching the market gurus. … started following few Television Gurus and their recommendations. Convinced with their wisdom started buying the recommended stocks. The stocks which were daily going up, behaved completely opposite as if they were waiting for my entry to happen…. Started reading books on Market starting from Richdad Poordad …

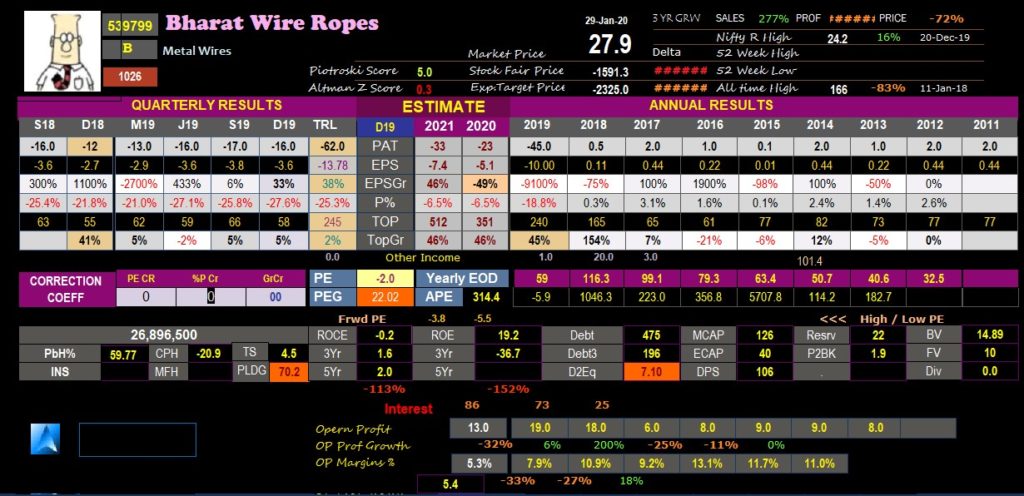

Then started learning about fundamental analysis… So good…What else needed few strict criteria ( Low PE High Growth Low Debt and High ROE/ROA/ROCE ) applied on the stocks traded in the market can give a list of stocks where I can invest.

The ratios were very interesting … and found out my own magic ratio. Debt and Reserve adjusted Rate of Return. I felt as if I am the master now. That did not work too always. Sometimes my best fundamental picks did not go north due to bad entry points. When I am fed up with that and sell after the same stock used to zoooom.

In the words of one of my learned Friend: Share market is a cauldron of several theories and postulates and models and… Theoretically, therefore, it cannot be deterministic. Only some trial and error model – heuristic – may help for some time. There are so many environmental variables in a stock price that it is not tenable to put them all in a simulation model. But if it is so uncertain then why try to predict it?

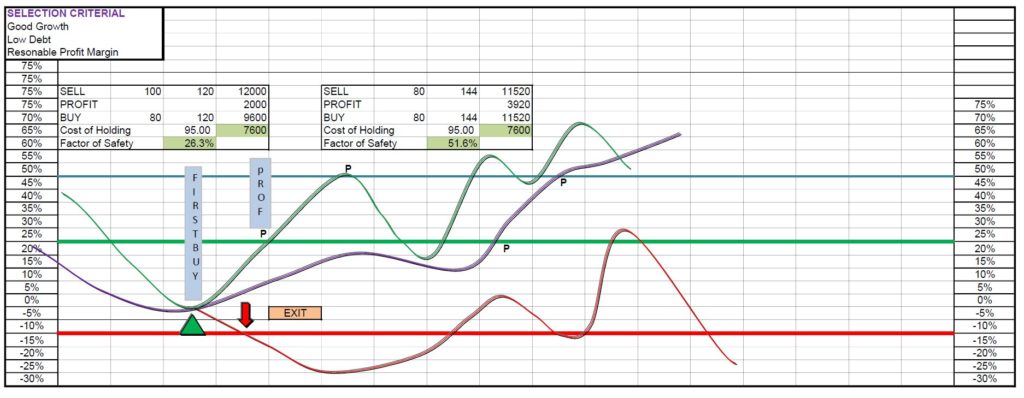

After years of meddling trying to learn from mistakes, realized… Good companies bought at a Technically Opportune time only will reward… For that, we have to marry the Technical Analysis with the Fundamental Analysis

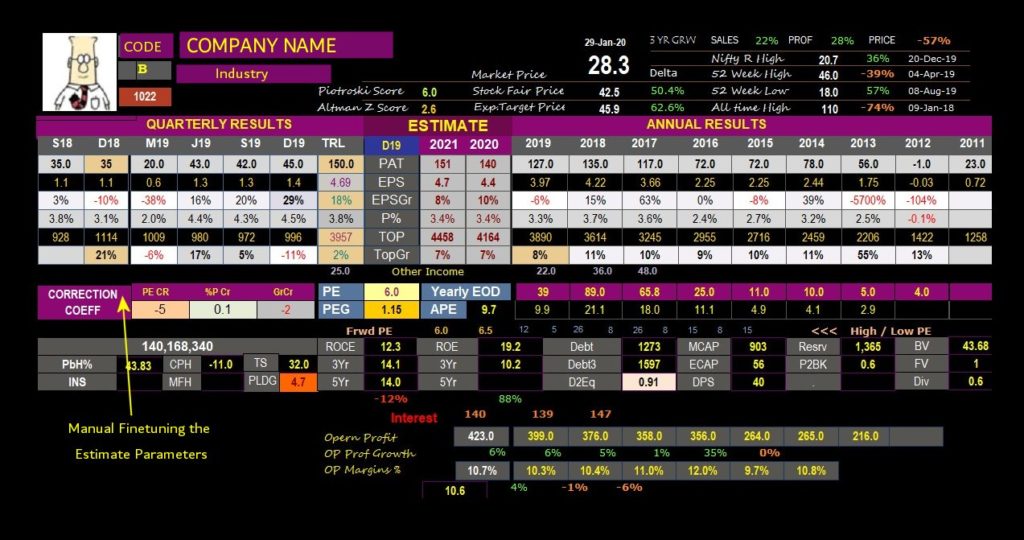

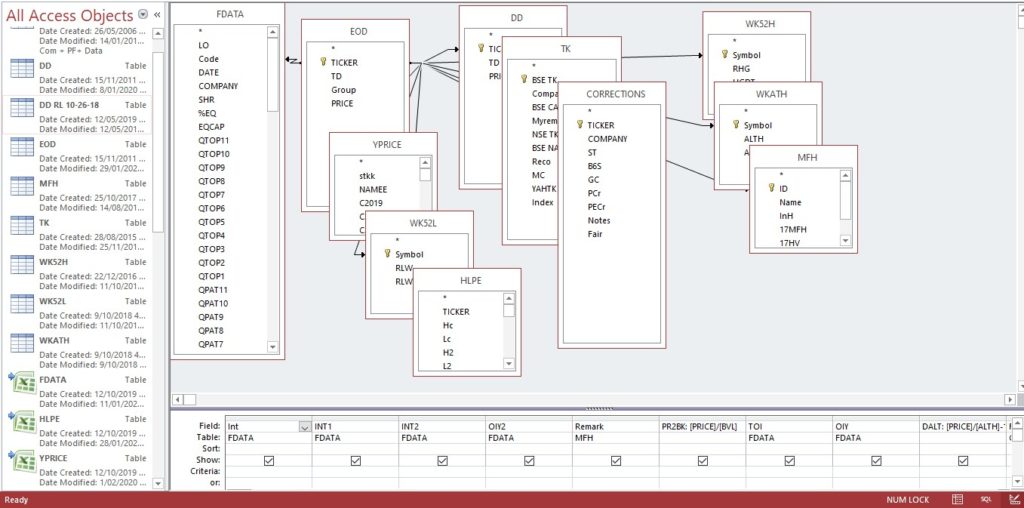

I have developed a stencil in Access database linking many Excel Sheets for initial analysis.

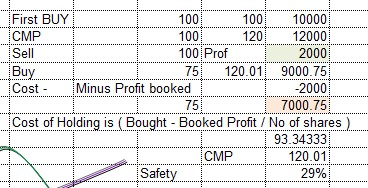

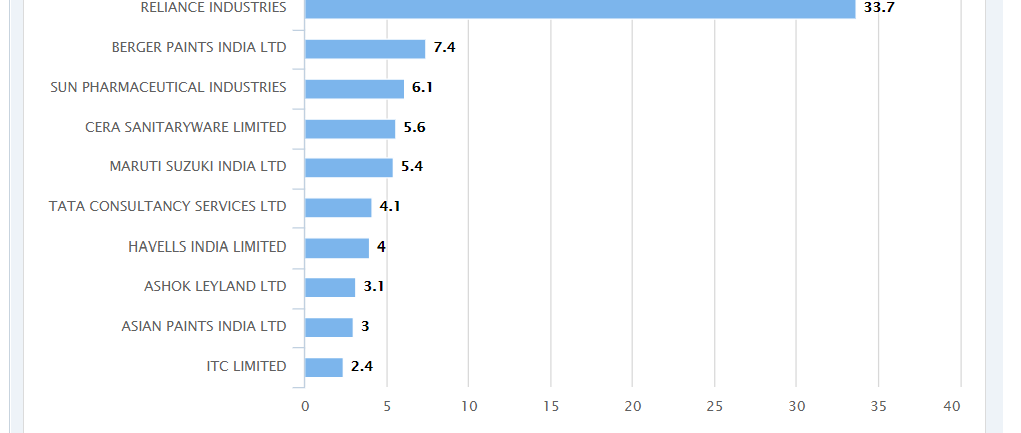

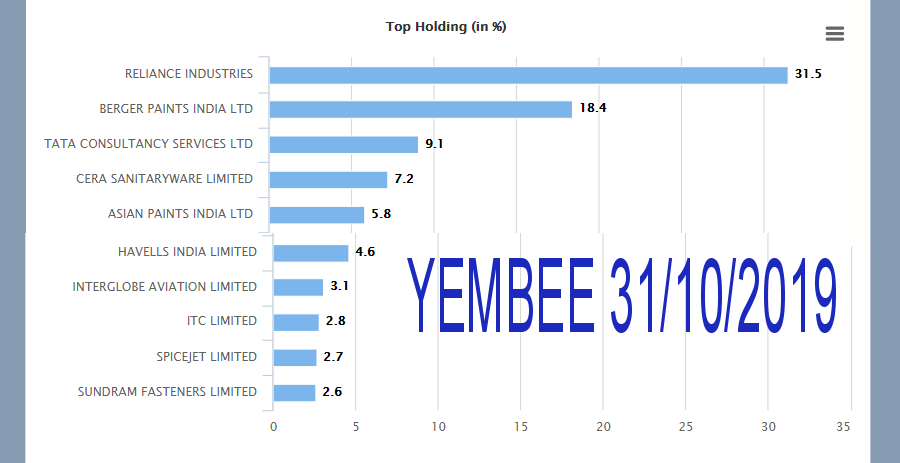

I have a combination of short, medium and long term bets. If the price is less by 25% of the average PE ( say 3 years ) x Trailing EPS; that qualifies for attention, provided the PAT and Topline Growth is consistent. Then I wait for entry till the MACD in the weekly chart turns favorable. After it achieves the desired target, I book profit ( i will write a separate page on profit booking model ) allow the profit to run long and started adding on strength

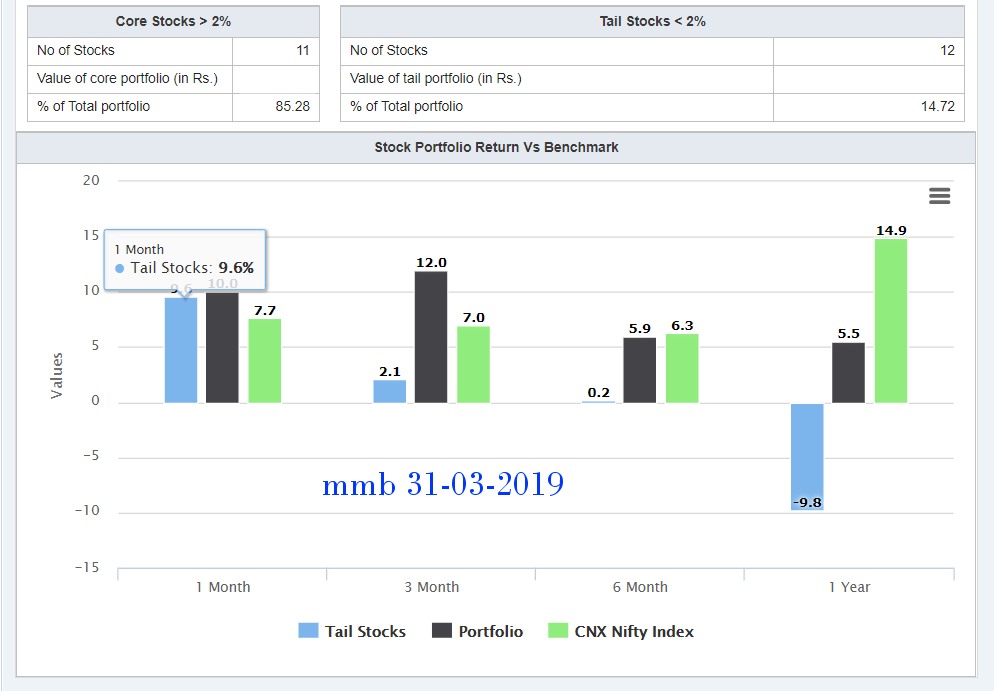

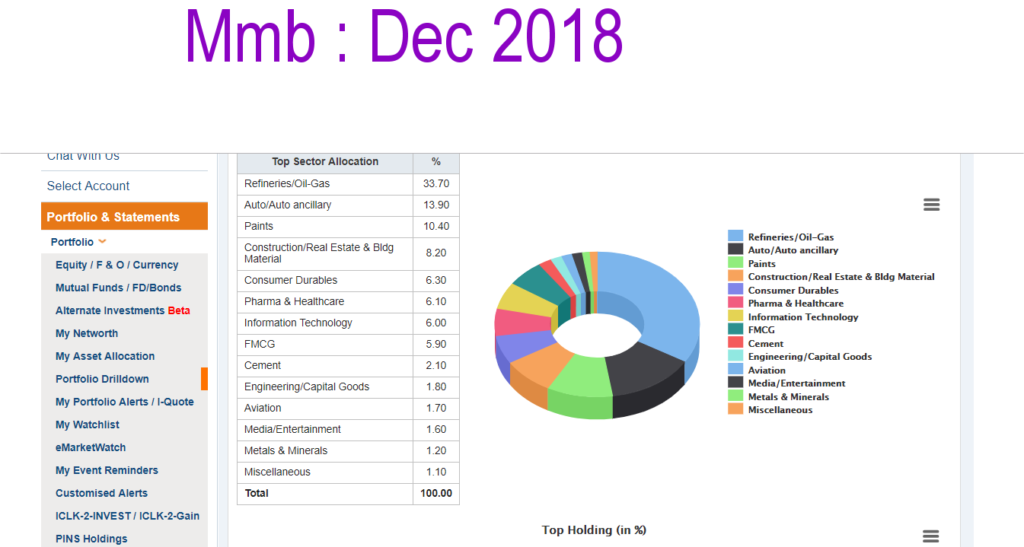

This process populates my PF. When my PF as a whole reaches new high I will sit and close all my laggards… So far so good … Tadpole to Frog … long way to go

Comment by Mr.Pradip Roy

Dear Mr Mohd Basheer

I appreciate ur efforts. Having said that may i put a note of caution! Look Share market is a cauldron of several theories and postulates and models and ….. Theoretically, therefore, it can not be deterministic. Only some trial and error model – heuristic – may help for some time. There are so many environmental variables in a stock price that it is not tenable to put them all in a simulation model. But if it is so uncertain then why try to predict it?

Share market is a very passionate lover. Once u have fallen for it, there is no looking back.and ,like any proverbial love story it will either strip u naked or adorn u with most adrable jewellaary !

My Reply

Dear Pradip Roy Sir,

Thank you very much for your words of wisdom. I understand there is no magic formula to calculate the swings of human emotion. As you said i am in love with this stock market whether it strips me naked or reward me…

The amount of analysis I do is not at all necessary, but it thrills me. If I zero in and buy a stock and it turns out to be a flop fascinates me to explore. The winners I am not exited of…

What irritates me is the creative accounting even from famous companies …

Anyhow I am in love with the market… The more it becomes unpredictable the more i am amused….

Thank you again

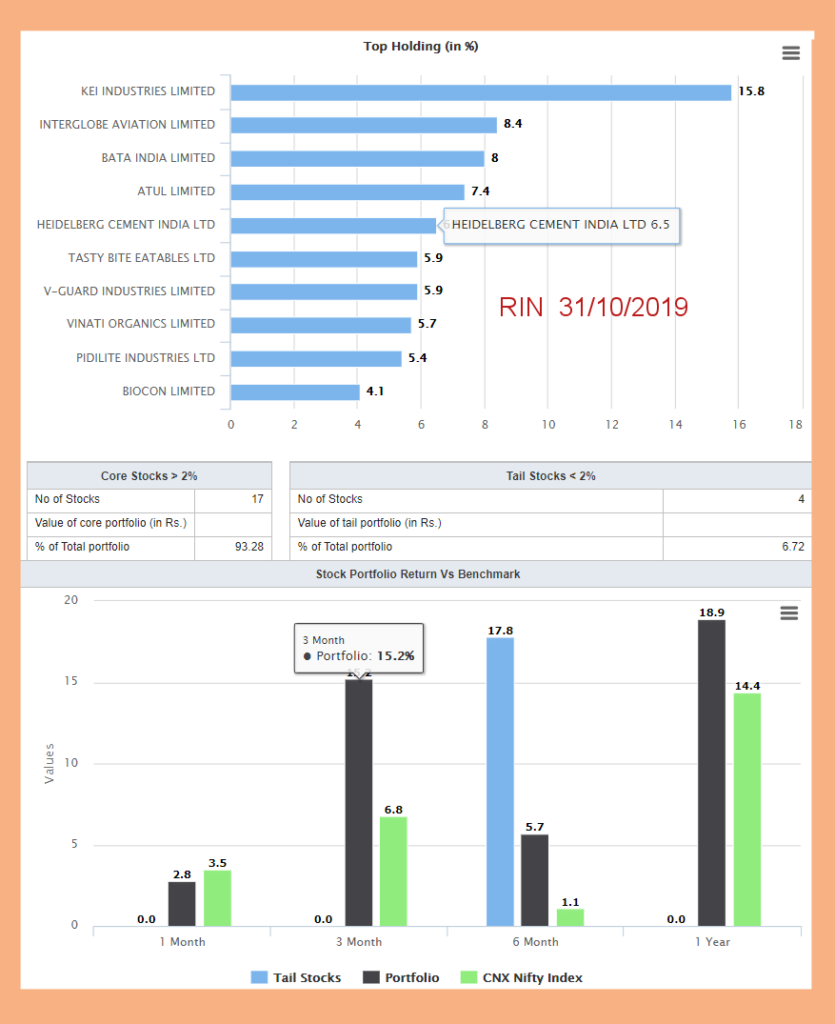

I collect watchlist of stocks from Result performance, Expert Picks, Recommendations from fund houses etc … and buy the first lot at a technically opportune time

I collect watchlist of stocks from Result performance, Expert Picks, Recommendations from fund houses etc … and buy the first lot at a technically opportune time